Bernie Sanders Supports Government Ownership in Tech: An Unlikely Agreement with Trump

In a surprising alignment, Bernie Sanders, the Independent Senator from Vermont known for caucusing with the Democrats, has expressed his agreement with a plan from the Trump administration. This plan proposes turning federal grants into equity stakes in tech companies, specifically targeting giants like Intel and TSMC. Sanders believes that if these companies profit from the substantial government-funded grants, taxpayers deserve a fair return.

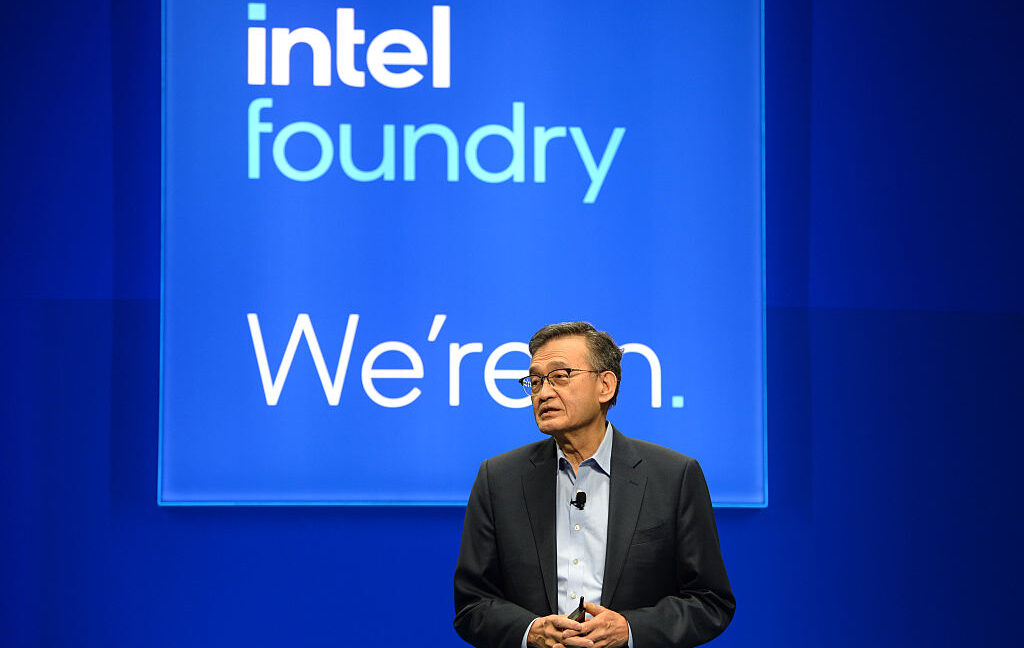

The U.S. government plans to acquire a 10% equity stake in Intel through federal funding provided via the CHIPS Act. This act has been critiqued as a significant handout to wealthy corporations. Howard Lutnick, the Commerce Secretary, emphasized that it is nonsensical to provide financial aid to billionaire firms like TSMC.

While companies like Intel and TSMC have been encouraged through the CHIPS Act to boost manufacturing within U.S. borders, a debate has erupted over whether providing simple financial grants is beneficial without government equity. The idea of the government obtaining an equity stake proposes potential influence over corporate operational decisions, while Lutnick reassures the public that there would be no governance role despite any stake.

"The Trump administration's CHIPS Act is under scrutiny for offering significant financial incentives to companies already valued at billions," says Lutnick. "The equity proposal, however, seeks more accountability and return for the American taxpayers."

The prospect of government intervention stokes unease on Wall Street, fearing that any equity arrangement could transform into more than just passive investment. With the possibility of significant political influence on corporate decisions, skepticism remains around Sanders' support, considering Trump's track record of directing institutions more intensely. Sanderson's backing of the equity stake is layered with potential conditions and wary insights into broader government and company interactions.