Bernie Sanders Backs Government Equity in Tech Firms

In an unusual convergence of thought, Bernie Sanders has expressed approval of a plan from the Trump administration regarding government stakes in tech companies. This plan aims to convert federal grants provided to tech giants such as Intel and TSMC into equity stakes, with the purpose of offering taxpayers a return on sizable government investments in these corporations.

According to statements made to Reuters, Sanders stated, "If microchip companies profit from the generous grants provided by the federal government, American taxpayers deserve a reasonable return on their investment." This reflects a shared sentiment with Donald Trump's administration, albeit rare in other policy areas.

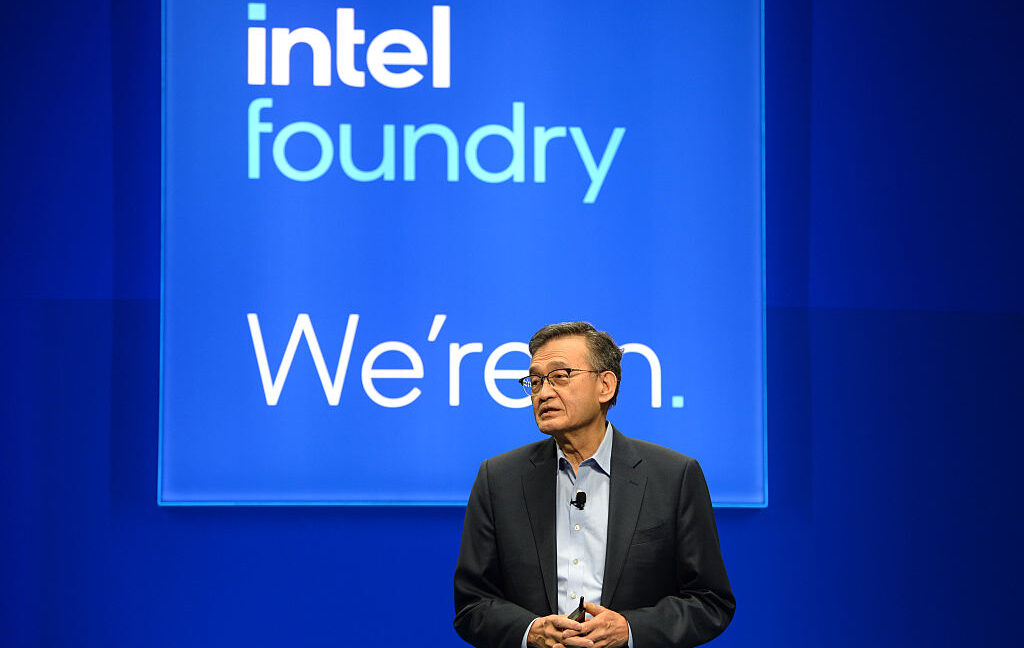

The plan, as articulated by Commerce Secretary Howard Lutnick, seeks a 10% equity stake for the U.S. in exchange for federal grants. This was publicized following Lutnick's CNBC appearance, where he criticized the CHIPS Act for merely handing funds to wealthy companies without getting substantial returns for the government.

While the CHIPS Act was introduced to incentivize manufacturing in the U.S. by companies like Intel and TSMC, there's growing bipartisan agreement on revisiting the strategy of offering financial grants without securing equity or influence in these corporations.

However, Wall Street and various stakeholders have shown unease over potential government participation in the corporate sector, suggesting that such investments might not remain passive. This backdrop led to Trump wanting an equity stake beyond Intel, looking towards firms like Micron and Samsung.

Moreover, Bernie Sanders' approval might be theoretical, since President Trump's methods in bending institutions' operational modalities may overshadow any official agreements. This also highlights how any matches with Trump's ideas by Sanders come with conditions.

Overall, as discussions continue around government involvement in large tech firms, the balance between securing returns for public investments and ensuring corporate autonomy remains delicate.