Unlikely Agreement: Sanders Supports Trump Plan for Government Stake in Tech Firms

In a rare moment of consensus, Senator Bernie Sanders has expressed his support for a proposal from the Trump administration to take equity stakes in major tech corporations, such as Intel and TSMC. This initiative involves transforming federal grants under the CHIPS Act into ownership stakes.

Sanders, an Independent senator known for his progressive policies, believes that if microchip companies profit from government support, it is only fair for taxpayers to benefit as well. "The taxpayers of America have a right to a reasonable return on that investment," Sanders told sources.

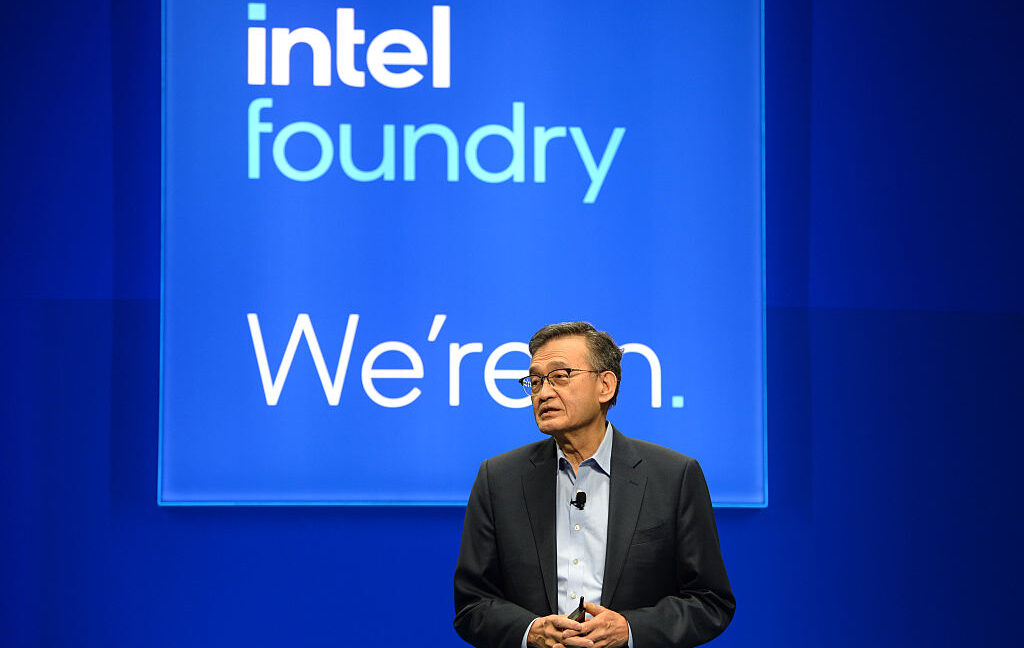

The U.S. government, through Commerce Secretary Howard Lutnick, has revealed plans to acquire a 10% ownership in Intel in exchange for these grants. This strategy aims to ensure that taxpayer money leads to more than just corporate enrichment, spurring debates across the political aisle on the benefits of such equity for the public.

The CHIPS Act incentivizes substantial investments in U.S. manufacturing from chipmakers, but it has triggered criticism. Many argue that significant sums are handed out without sufficient returns for the nation. Sanders’ backing highlights a shift towards demanding corporate accountability and reshaping government involvement in private industry.

A concern raised by some sectors, especially Wall Street, is the potential for government overreach in business decisions. While the Trump administration assures that governance roles will remain unaffected, skeptics worry about future implications of such deals.

The proposal also touches upon broader implications of governmental stakes in private companies. It mirrors historical instances of federal intervention, like the automotive industry bailout during the financial crisis, emphasizing that these stakes might influence company strategies.

This bipartisan moment reflects growing sentiment for reforming corporate incentives. However, apprehensions remain about the administration's influence on companies’ operational decisions and broader economic strategies.