SoftBank to invest $2 billion in Intel, betting on U.S. chip manufacturing and AI

SoftBank is committing $2 billion to Intel through a purchase of common stock, a move that underscores the investor’s push into advanced technology and U.S. semiconductor manufacturing.

The agreement was disclosed after markets closed. SoftBank will acquire shares at $23 apiece; Intel ended the regular session at $23.66, and the stock climbed more than 5% in after-hours trading.

SoftBank Group’s chairman and CEO framed the transaction as a strategic bet that U.S. capacity for cutting-edge chip production and supply will expand, with Intel positioned to play a pivotal role.

The deal serves as a vote of confidence for Intel, which in recent years has been eclipsed by rivals in high-performance chips. It also signals SoftBank’s renewed focus on the U.S. AI chip ecosystem. Earlier this month, the company acquired a facility in Lordstown, Ohio, formerly owned by Foxconn, to support a plan to build AI data centers.

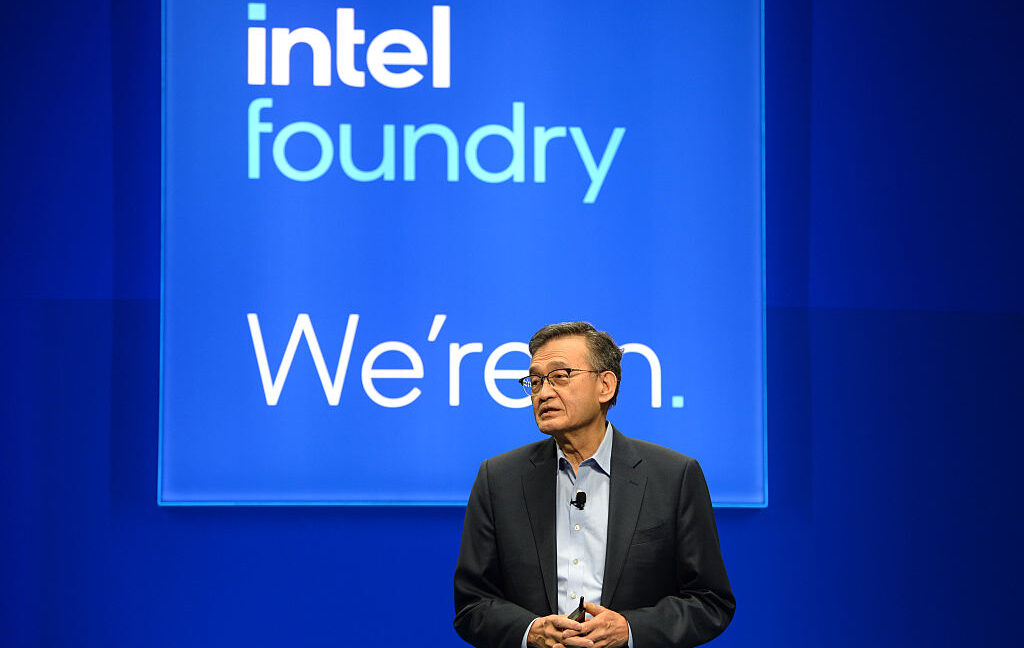

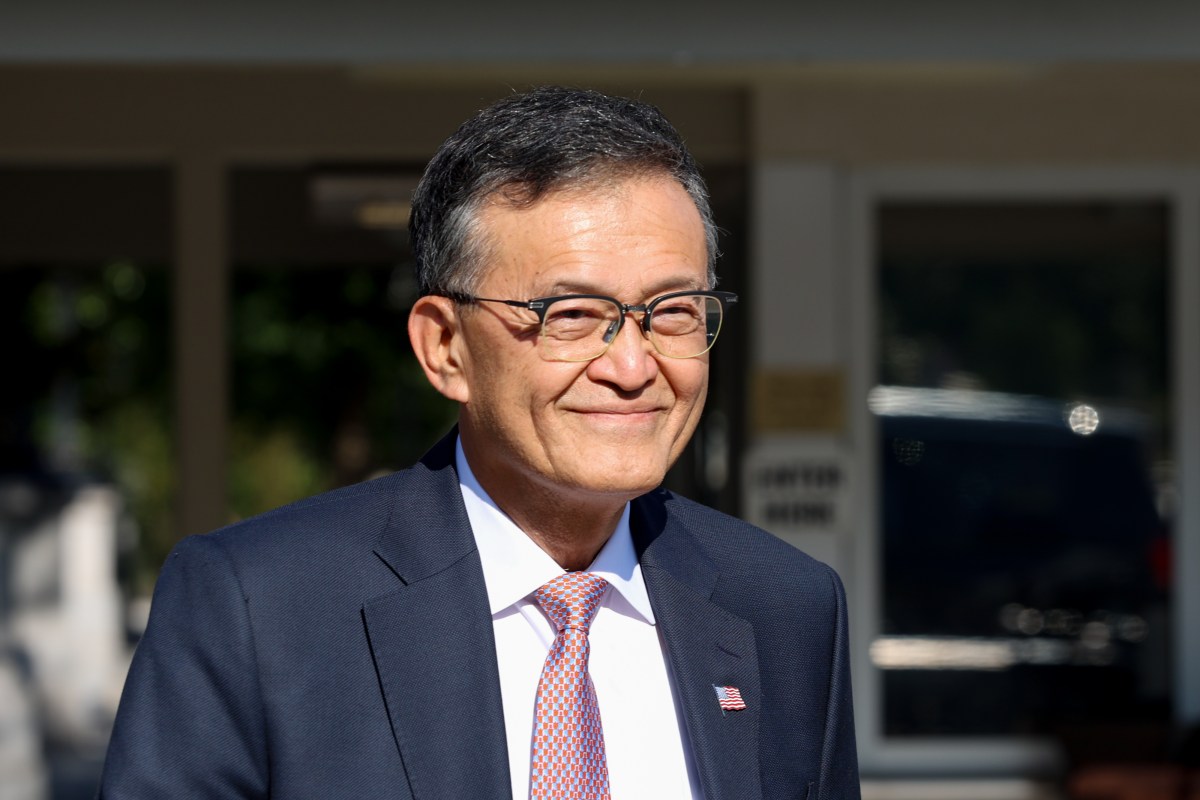

Intel, now led by CEO Lip-Bu Tan, is deep into a restructuring aimed at streamlining operations and centering on its core client and data center businesses. Over the summer, the company shuttered its automotive architecture unit and made significant layoffs. It also outlined plans to reduce headcount in the Intel Foundry division by roughly 15% to 20%.

The backdrop is politically charged. In recent weeks, President Donald Trump publicly urged Tan to resign over alleged conflicts of interest, while his administration reportedly considered taking a stake in Intel.

The timing also coincides with the administration’s threat to introduce new tariffs on imported semiconductor chips as part of an effort to bolster domestic production. Against that context, SoftBank’s investment highlights growing private-sector momentum behind U.S.-based chip manufacturing.