SoftBank commits $2B to Intel in vote of confidence for U.S. chipmaking

SoftBank is putting $2 billion to work in Intel through a purchase of common stock, a move the companies framed as a long-term bet on advanced technology and domestic semiconductor capacity in the United States.

The investment was announced after markets closed on Monday, with SoftBank agreeing to pay $23 per share. Intel ended regular trading at $23.66 and jumped more than 5% in the after-hours session following the news.

SoftBank Group Chairman and CEO Masayoshi Son underscored the rationale behind the deal, pointing to the expanding role of U.S.-based chip production and Intel’s place in that ecosystem.

“This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” Son said.

For Intel, the backing serves as a timely vote of confidence as it works to regain ground lost to rivals in high-performance computing and AI. The transaction also highlights SoftBank’s renewed push into U.S. chip infrastructure; earlier this month, the group purchased a Foxconn facility in Lordstown, Ohio, as part of a broader plan to build AI data centers.

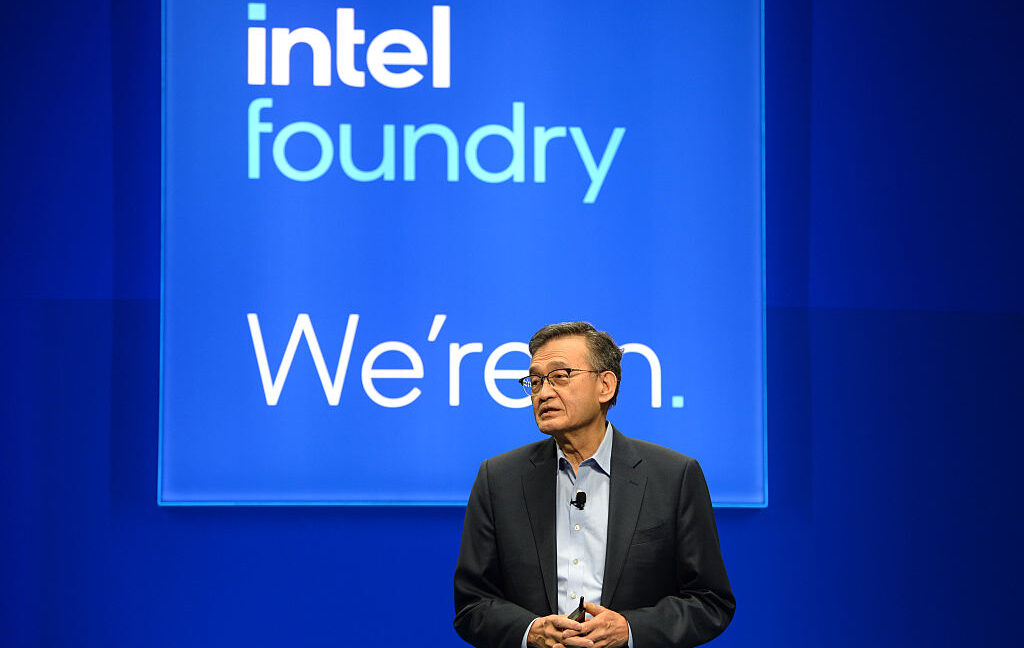

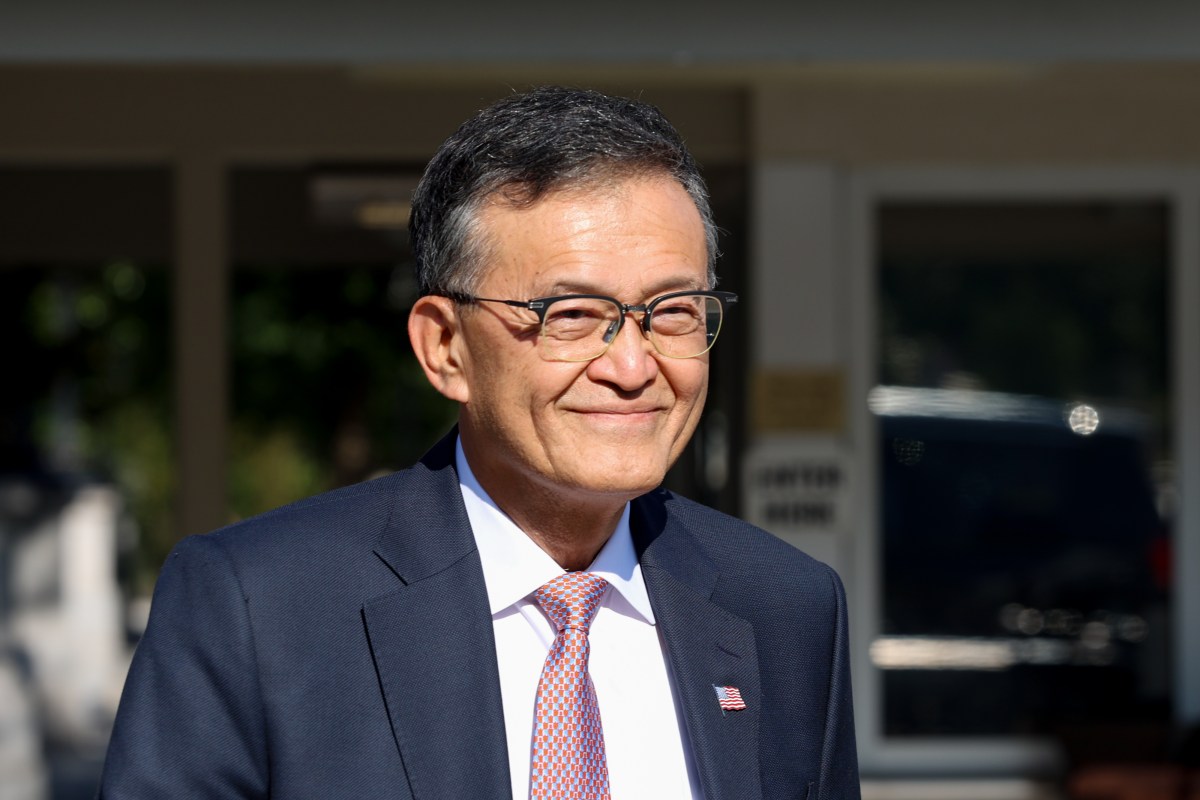

Under new CEO Lip-Bu Tan, Intel is pursuing a restructuring to streamline operations around its core client and data center businesses. This summer, the company shut down its automotive architecture unit and enacted significant layoffs. It also outlined plans to trim headcount in the Intel Foundry division by an estimated 15% to 20%.

Tan’s early tenure has unfolded amid unusual political crosswinds. In recent weeks, President Donald Trump publicly called for Tan’s resignation over alleged conflicts of interest, and members of the administration reportedly discussed taking an equity stake in Intel.

The fresh capital arrives as the White House threatens new tariffs on imported semiconductor chips in a bid to bolster domestic manufacturing—policy shifts that could shape how both Intel and SoftBank position their next moves.

Taken together, the investment, restructuring efforts, and evolving U.S. industrial policy suggest a pivotal period ahead for Intel’s turnaround and for broader ambitions to scale AI-era chipmaking on American soil.