SoftBank's Strategic $2B Investment in Intel: A New Era for Technology and Innovation

SoftBank has announced a substantial $2 billion investment in Intel, marking a strategic move to solidify its presence in advanced technology and semiconductors in the U.S. This investment is part of a broader strategy to enhance semiconductor manufacturing, with Intel at the forefront of these efforts.

The investment agreement was finalized after markets closed, with SoftBank purchasing Intel common stock at $23 per share. Intel's share value surged over 5% in after-hours trading, reflecting market confidence in this deal.

Masayoshi Son, SoftBank's Chairman and CEO, emphasized that this strategic investment underlines the company's belief in the expansion of advanced semiconductor manufacturing and supply within the United States, with Intel playing a pivotal role.

For Intel, this investment brings renewed credibility as it competes with rivals like Nvidia. It aligns with SoftBank’s increasing focus on AI chips, as evidenced by their recent acquisition of a Foxconn factory in Ohio, intended for AI data center development.

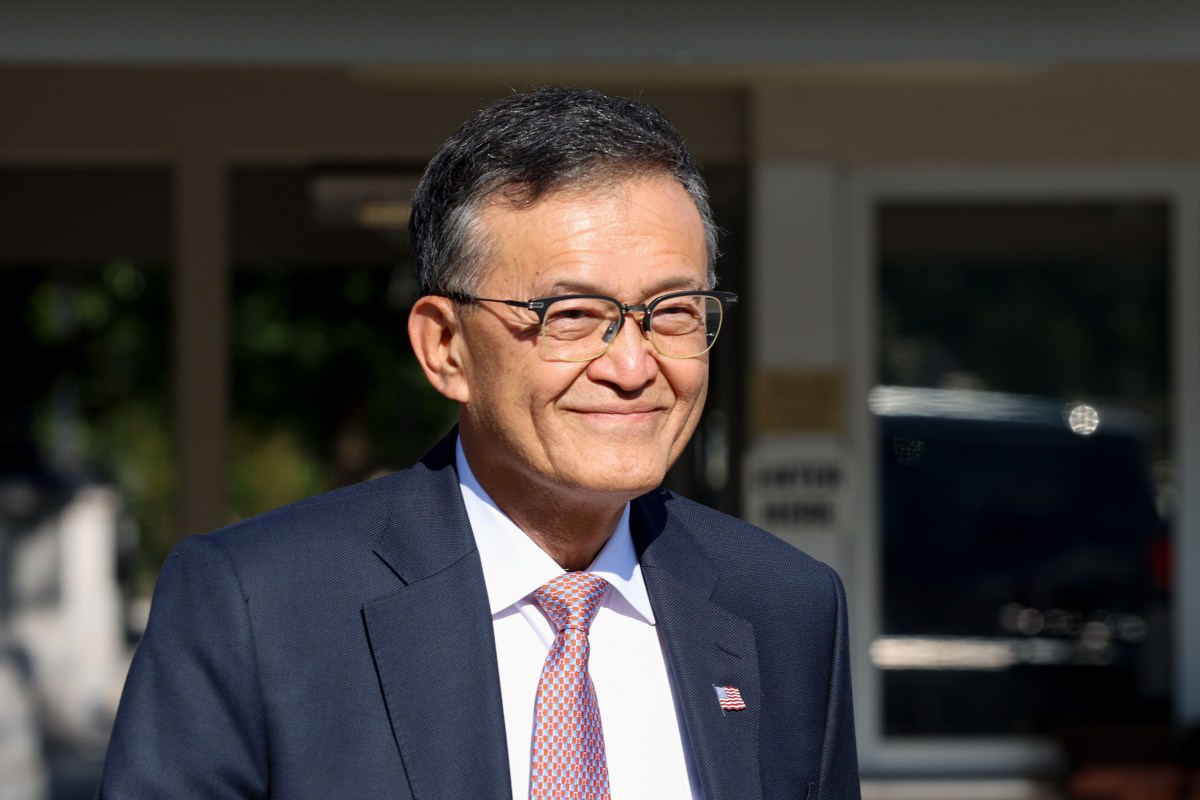

Under the leadership of new CEO Lip-Bu Tan, Intel is undergoing significant restructuring. This includes streamlining its semiconductor business and refocusing on key areas such as client and data center portfolios. Previous decisions this year saw the closing of its automotive architecture segment and noticeable workforce reductions in its Foundry division.

Intel’s CEO, Lip-Bu Tan, has also faced political challenges against the backdrop of President Donald Trump's call for his resignation over alleged conflicts of interest, which remain unproven. Moreover, the Trump administration is reportedly considering taking a stake in Intel as part of its broader agenda to bolster domestic semiconductor production.

This investment announcement coincides with recent tariff threats by the Trump administration on imported semiconductor chips, reinforcing the strategic importance of domestic chip production.