SoftBank Injects $2B into Intel for Advanced Technology Ventures

In a strategic move, Japanese conglomerate SoftBank has unveiled a $2 billion investment in Intel, solidifying their commitment to advancing technology and semiconductor innovation within the United States. This agreement underlines SoftBank's confidence in Intel's capabilities and ambition in the semiconductor industry.

The comprehensive deal involves SoftBank purchasing Intel common stock, paying $23 per share. This announcement, made after market hours, led to a notable uptick in Intel's share price, which had closed at $23.66 but surged by over 5% during after-hours trading.

Masayoshi Son, SoftBank Group Chairman and CEO, emphasized the strategic importance of this investment, noting the crucial role Intel plays in the anticipated expansion of semiconductor manufacturing on American soil. This capital injection serves as a major endorsement for Intel, which intends to strengthen its position amidst competition from industry giants like Nvidia.

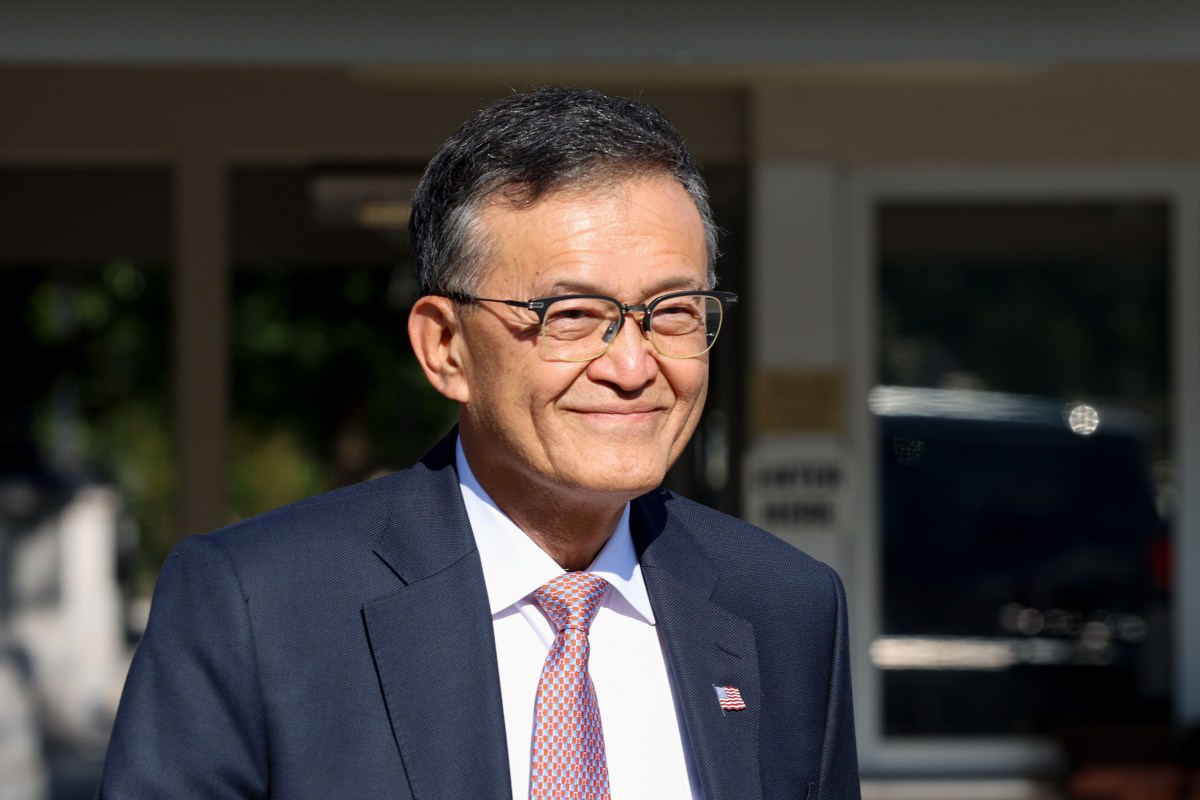

Intel, under the leadership of CEO Lip-Bu Tan, is undergoing significant restructuring. The company is strategically refocusing on its core strengths in client and data center solutions, a move that includes the recent closure of its automotive architecture division. Furthermore, plans to downsize the Intel Foundry division workforce by up to 20% have been previously announced.

This investment aligns with SoftBank's renewed interest in the U.S. market, especially in areas involving AI chips. Recently, SoftBank also acquired a factory in Ohio from Foxconn as part of a broader initiative to establish AI data centers.

In recent developments, Intel has been navigating complex political challenges. President Donald Trump has publicly called for CEO Tan's resignation due to alleged yet unsubstantiated conflicts of interest. Moreover, the Trump administration has engaged in conversations about acquiring a stake in Intel, adding a political dimension to the company's strategic maneuvers.

The timing of SoftBank's investment is particularly significant given the Trump administration's recent announcement of possible new tariffs on imported semiconductor chips, a move aimed at stimulating domestic production.